Our detailed Acorns review reveals its user-friendly platform, automatic savings features, and investment opportunities, helping you grow your wealth one small step at a time. Acorns is a robo-advisor that automatically invests your spare change. It’s a great hands-off investment app for novices, but what are its downsides?

Acorns App Review

Growing up, did you ever have a piggy bank or change jar?

Each month, you’d save up a little of your allowance. When you got older, you’d start adding money earned from summer jobs during school breaks. And whenever you had enough saved up, you’d treat yourself to something special – maybe that toy you’d been eyeing at the store – or your first car.

Saving probably seemed a lot easier back then. Textbooks, instant ramen, and Starbucks to fuel those late night study sessions and early morning lectures… Once you hit college, it starts to feel as if there’s never enough money.

Then you get your first job, and before you know it, your rent and taxes have gobbled up your wages. You’re still stuck eating ramen for dinner and the car you bought when you were sixteen has had its “check engine” light on for months. At this point, you’re caught between wanting to save the environment and hoping the world will end before you hit 65 because you simply don’t have enough to save up for retirement.

Well, remember that change jar? Acorns has modernized that faithful old practice with their automated savings and investment app.

All you need to do is sign-up, either via the free app or online, depending on which you’re more comfortable with. Bear in mind that most of what you do is going to be through the app.

Once you’ve linked your bank card (or cards if you have more than one) and chosen an investments account, Acorns rounds up all your purchases.

So if you spend $4.75 on a Venti Caramel Macchiato at Starbucks, Acorns rounds that up to $5 automatically. In actuality, that $0.25 “change” is kept note of by the app’s computer-generated algorithms, and only once all your change adds up to a minimum of $5 does it get withdrawn and swept into your Acorns account.

This makes the robo-advisor especially ideal for novice investors – particularly millennials, who tend to shy away from investing.

In fact, considering Acorns only costs $1 to $3 depending on your account type and doesn’t have any account minimum, it’s an ideal solution for anyone who wants to get started but doesn’t have the time to manage their own account.

And with a special deal for students (four years free), it’s never too early to get started.

But of course, no investing platform is absolutely perfect. So before you rush off to download the app, take the next 15 minutes to give the rest of our review a read.

Acorns Review: Quick Facts

- Management fees: $1 to $3/month (depending on account type)

- Account minimum: $0 (no minimum)

- Promotion: Up to four years Acorns Core for free as a student with a valid .edu email

Acorns is Best For

While targeting millennials especially, Acorns is a great investing and saving platform for first-time investors of any age. Here are those who will get the most from the app:

- College students and graduates

- Anyone who struggles to save

- Investors who prefer a hands-off, “set it and forget it” approach

- Novice investors

Acorns Review: Pros

As far as app-based robo-advisors go, Acorns is one of the best. Here’s everything we love about the platform.

Up to 4 Years Free Management for College Students

Acorns, as mentioned, is primarily concerned with making investing a viable and attractive practice to the youth.

To help drive in that endeavor, they offer up to four years of free management for students with a valid .edu email account. This can help students build up quite a nice account balance before having to pay.

For those four years, students enjoy all the benefits of Acorns Core, the primary account package, which usually costs $1/month. Acorns Core boasts the following features:

- Automated investing

- Personalized portfolios

- Grow Magazine

- Found Money

- Access to 150+ customer support financial experts

We’ll be exploring these features in greater detail as part of the “pros” section.

Low Minimum Investment

While you don’t need any deposits to open an Acorns account, there is a $5 minimum investment.

This is remarkably low. Using our earlier example, you’d only need to buy 20 Venti Caramel Macchiatos for the round-up to total $5. And we’re willing to bet that you aren’t only using your card at Starbucks.

No Withdrawal Fees

Like most robo-advisors, Acorns doesn’t charge any withdrawal fees.

However, you should remember that withdrawals aren’t going to be instant. The SEC enforces a two-day minimum waiting period after selling an asset. Acorns sometimes turns this into a five-day waiting period in order to prevent fraudulent activity.

Grow Magazine

Acorns makes it super easy for investing novices to learn the ropes.

Grow Magazine, their online publication, is full of personal finance resources. You’ll find advice on side hustles, student loans, credit card debt, and other financial topics, as well as defining key investment terms. Everything is written using clear, easy-to-understand language – you won’t need a degree in economics.

The Acorns app has Grow Magazine integrated for clients, but you can also subscribe online without having to sign-up as a customer.

Automated Investing

One of the reasons people shy away from investing is because it can be an overwhelming complex practice. Even saving requires some mental gymnastics and discipline. In fact, it’s often said that the hardest part of saving is actually doing it.

But by automating that process, Acorns turns a serious brain exercise into a relatively mindless activity. And if you don’t have to actively remember to save, you’re more likely to do it.

As explained in our introduction, Acorns turns saving and investing into a hands-off practice by monitoring purchases made with all of your linked cards. The “change” (like that $0.25 from your Venti Caramel Macchiato) is made note of. You can even keep track of your change in the app. Once it totals $5, Acorns withdraws it from your checking account for you.

Customize Transactions

If you’re finding that you’re really tight for money and the spare change Acorns automatically rounds up is too high, you can switch off the round-up feature.

When you do this, you have a few options for making sure that you’re still putting money aside. One of these is to customize your transactions by manually selecting which purchases you want rounded-up.

Personalized Investment Portfolio

The money in your Acorns account is automatically added to your personalized investment portfolio.

When you sign-up, you provide personal data such as your age, savings goals, income, and target retirement age. Based on this information, Acorns’ computer-generated algorithms recommend one of five portfolio types. And if you don’t like the recommendation for any reason, you can easily choose a different one.

Portfolio Types

When we talk about portfolio types, we’re talking about investment strategies. These range from conservative to aggressive.

Basically, the portfolio type recommended (or chosen by you) will diversify your investments across six asset classes:

- Large company stocks

- Small company stocks

- Emerging markets

- Government bonds

- Corporate bonds

- Real estate stocks

These assets are bought and sold in the form of exchange-traded funds (ETFs).

IRA Account

If you upgrade from Acorns Core to Acorns Later, you get a few extra benefits in exchange for a management fee increase to $2/month.

One of these benefits is a traditional individual retirement account (IRA) recommendation.

While IRAs are typically rather expensive to set up, requiring a minimum deposit that’s higher than standard taxable accounts, Acorns makes it as simple as one, two, three. Your spare change gets used to fund your IRA. It won’t be nearly enough to retire on alone, but can supplement an employer-sponsored retirement plan when you later get one.

Acorns Later also includes the following benefit upgrades:

- Automatic rebalancing – as your account balances approach your goals, Acorns adjusts your investment strategy accordingly

- Recurring investments (we’ll address this separately)

- Assisted rollovers – if you already have an IRA or 401k, Acorns will help you rollover to Acorns Later

Round-Ups Multiplier

So long as you have the automatic round-up feature still activated, you can enable the Round-Ups Multiplier.

You can then select a multiplication amount – double, triple, or x10. This increases the amount of money being rounded up with each transaction. For example, with the double multiplier set, instead of just $0.25 “change” from your Venti Caramel Macchiato, you’ll invest $0.50.

Recurring Investments

One of the feature upgrades from Acorns Later, recurring investments allows you to set a monthly boost. For example, you can choose to add an extra $5+ to the week or month’s savings.

Found Money

Spare change is only going to take you so far, even with the Round-Ups Multiplier set to x10.

But you know what’s better than investing your own change and recurring contributions? Getting a percentage of your cash back from the companies whose products and services you purchase and having those Found Money Rewards invested.

Acorns has more than 200 partners that give cash backs on your purchases, which are then added to your investment account.

It typically takes 60 to 120 days for these cash backs to be processed, but you can expect a fair amount depending on where you spend money. Those 200+ partners include Airbnb, Amazon, Apple, Hulu, Macy’s, and Nike.

Acorns Spend

The third and final service level available is Acorns Spend, at $3/month. This is an online checking account, which comes with its own Visa debit card made from tungsten.

In addition to the benefits of Acorns Core and Acorns Later, you’ll enjoy:

- Real-time round-ups, automatic retirement savings, customized Spend Strategies, and more

- Direct deposits, free bank-to-bank transfers, and an unlimited number of free or reimbursed ATM fees

- Up to 10% more Found Money

- No overdraft or minimum fees for the checking account

- Additional financial tips

- 256-bit data encryption, all-digital card lock, fraud protection, and up to $250,000 FDIC insurance

Acorns Review: Cons

Of course, every platform comes with its own set of drawbacks. Here are our contention points regarding Acorns.

Management Fees

The thing with management fees is that you have to think of them as a percentage of your account balance. Take a look at how this adds up:

| Account Balance | Acorns Core | Acorns Later | Acorns Spend |

| $100 | 12% | 24% | 36% |

| $500 | 2.4% | 4.8% | 7.2% |

| $5,000 | 0.24% | 0.48% | 0.72% |

| $10,000 | 0.12% | 0.24% | 0.48% |

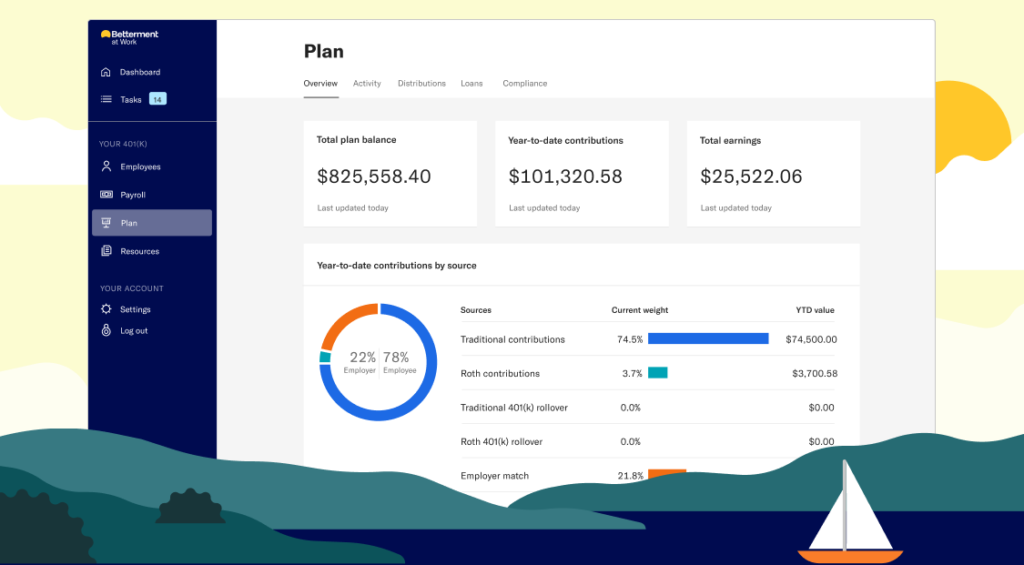

Wealthfront and Betterment, the robo-advisory pioneers, only charge 0.25% (the later moving up to 0.40% only after you upgrade to Betterment Premium, with an account minimum of $100,000).

This makes Acorns comparatively expensive, especially for lower account balances.

No Tax Benefits

Acorns doesn’t offer any tax benefits, such as tax-loss harvesting or any other assistance. In fact, the 1099 you’ll receive via snail mail come time to file your taxes is the only type of tax advice you’ll receive.

Small Portfolio

The five portfolio types Acorns offers only handle between five to seven asset classes, depending on which investment strategy was recommended to you. That’s smaller than most other robo-advisors. As you gain more experience, you’ll find it rather restrictive.

Is Acorns Right For You?

This really depends on your situation.

If you want to make the most of the spare change that – if it were cash – would usually just get lost to the washing machine, plus benefit from the occasional cash back, then Acorns is definitely the best platform. Stash, which offers a comparable service, falls far short in comparison.

But that said, you shouldn’t rely on Acorns alone, especially not for the long-term. This is even truer regarding your IRA.

Conclusion

If you’re someone who struggles with saving and/or is hesitant to start investing, Acorns is an ideal solution for you. That being said, their relatively high management fees for accounts lower than $5,000 to $10,000 may give you cause to pause.

Still, at the end of the day, there’s no better way to get a head start or supplement your other investment avenues.