Our detailed SoFi app review delves into its innovative features, lending options, and investment opportunities, providing insights to help you achieve your financial goals. Is SoFi a super-star, all-round financial company worth investing with? Our review will help you make an informed decision on your financial future.

SoFi Loan Review

Since the company was founded in 2011, SoFi (short for “social finance”) has built a reputation for itself as a personal loans platform.

But that’s not all there is to the company. SoFi also provides student loan refinancing services; home loans; member experiences (where you can attend financial advice workshops, network with other members in your industry, and participate in career workshops); one-on-one career coaching; and life insurance.

SoFi Savings Account

They even offer a hybrid high-yield savings account called SoFi Money, with an annual percentage yield (APY) that beats CIT Bank’s Premier High-Yield Savings account.

In 2017, SoFi also added a new service to their already impressive list: SoFi Invest, formerly known as SoFi Wealth.

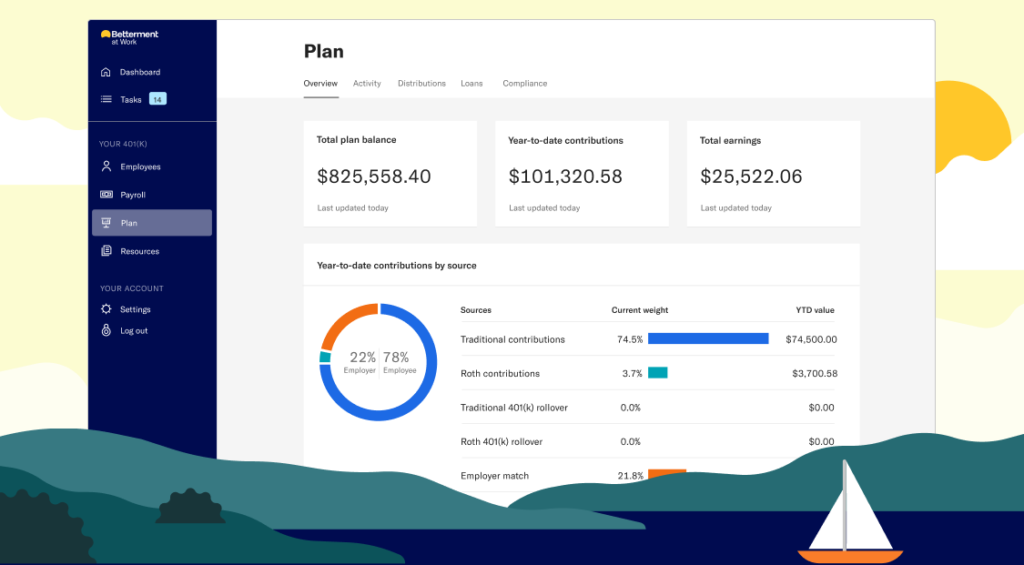

With SoFi Invest, members can choose between Active Investing and Automated Investing. The company comes into direct, aggressive competition with other robo-advisors, including the industry’s pioneers, Betterment and Wealthfront.

SoFi Automated Investing is a particularly attractive option for new investors or those otherwise looking to gain some experience. You set your goals and SoFi recommends a portfolio, which you can then customize or give the green-light on.

For example, SoFi makes the following broad investment strategy recommendations based on common goals:

- Wedding – conservative portfolio with low-risk for short-term goals (6 months to 3 years)

- Buying a home – moderately conservative portfolio with low-risk for short-term goals (3 to 5 years)

- Financing a trip – moderate portfolio with medium-risk for mid-term goals (5 to 10 years)

- Early retirement – moderately aggressive portfolio with medium- to high-risk for longer-term goals (5 to 20 years)

- College savings for your children – aggressive portfolio with high-risk for long-term goals (10+ years)

All portfolios include automated diversification to help balance risk and returns. You can open an Automated Investing account with as little as $100, or even opt for a $20/month deposit. That’s an incredibly low account minimum, especially considering many other robo-advisors have a minimum of $500+.

There are no management or transaction fees either. Additionally, you can contact a certified financial planner to help with your investments at any time; adding a human touch to the robo-advisory approach.

But there’s no such thing as a free lunch, of course.

With SoFi Automated Investing, you’re limited to index fund investments – and they don’t offer tax-loss harvesting, a strategy used to minimize your losses and improve your returns.

This makes them less attractive to more experienced investors. But considering SoFi’s target market is predominantly Ivy League students and beginner investors, they’re still an attractive company.

SoFi Quick Facts

- Account minimum: $100 opening deposit, or a recurring monthly deposit of $20

- Management and transaction fees: $0

- Promotions: Complimentary career and financial counseling and loan discounts with a qualifying deposit

SoFi App Review: SoFi is Best For

Just because SoFi’s target market are millennials (and especially Ivy League students), that doesn’t mean the firm isn’t an attractive opportunity for others too. SoFi Automated Investing is best-suited for those who match one or more of the following demographics:

- Novice investors

- Students and recent graduates, or younger people in general

- Hands-off investors

- Investors who need or otherwise appreciate financial planning assistance

- Those who are cost-conscious

- Those who want to start investing but don’t have access to a lot of funds

SoFi Pros

As you’ve no doubt gleaned from the introduction to our SoFi review, there’s a lot to love about the company – and especially their Automated Investing model.

Low Account Minimum

With a target market comprised mainly of college students and graduates, it’s no wonder SoFi Automated Investing has such a low account minimum.

This is a demographic that famously has very little money and tends to shy away from investing. So having an opening account minimum of just $100 – or the option to set up automatic monthly deposits of $20 – makes SoFi a more attractive, safer-feeling first step into the world of online investments.

Competitive Fees

SoFi previously charged an industry standard management fee of 0.25% for investors who aren’t borrowers, or who had an investment account of more than $10,000. However, the company did away with its management fee altogether in 2018.

This puts them ahead of their major competitors in the robo-advisor and online discount brokerage industry.

Furthermore, there are no administrative fees. While most of their competitors will charge you for closing an account with them, SoFi does not. And if you’re transferring from a rival brokerage, SoFi may even help you pay the transfer fees those other companies often charge.

All of this makes SoFi an incredibly investor-friendly platform.

Broad Range of Low-Cost Investment Opportunities

Even though SoFi focuses solely on exchange-traded funds (ETFs), they use a broad range in building client portfolios, tracking more than 20 indexes.

These indexes and ETFs also expose investors to a broader range than many of SoFi’s competitors allow for. As a customer, you’ll enjoy exposure to U.S. and international stocks, real estate, Treasury and high-yield bonds, and specific countries and regions. Using your individual investment objectives and risk-tolerance, SoFi uses this range to automate portfolio diversification for you.

Considering SoFi’s status as a relatively new company, this is an impressive offering. In fact, it’s one of the widest available robo-advisor investment opportunities on the market, on par with Ellevest.

Not only is there a wider-than-average range of ETFs, but the company is also geared toward cost-conscious investors. With a weighted average cost of just 0.085% for a typical SoFi Automated Investing portfolio, they aggressively compete with some of the cheapest big-name robo-advisors, including Ally Invest, E*Trade, and Wealthfront.

Automatic Account Rebalancing

As mentioned above, your portfolio is automatically diversified through a personalized selection of stocks, bonds, and funds, all based on your financial goals and risk tolerance.

But while diversification is in and of itself a defense against losses incurred from fluctuations in the notoriously volatile market, you don’t want to have to rely on diversification alone.

That’s where SoFi’s automatic account rebalancing comes into play. Any time your investment allocations start deviating from your plan, the computer-generated algorithms that make up SoFi’s robo-advisor program will rebalance your account. This typically kicks in when there’s a deviation of 5 points, which SoFi checks for on a daily basis.

But that’s not the only time automatic rebalancing happens. Because you can choose to deposit or withdraw money from your investment account at just about any time, the program also tracks your allocation against your account amount. Any time money leaves or enters your account, for any reason, the software will automatically rebalance your account for you.

Portfolio Strategy Adjustment

As time goes by and your financial situation improves, you’ll find that your risk-tolerance changes.

SoFi understands this. While some robo-advisors hold you to the risk-tolerance you set when you first signed on as a client, SoFi allows you to adjust your investment strategy as need be. And to help you make the right choice when considering a portfolio strategy adjustment, they have a veritable army of financial advisors on hand.

Commission-Free Financial Planners

SoFi stands out among competitors like Wealthfront – who offer 100% robo-advisor plans with no access to human financial planners.

Having a live financial advisor available is practically invaluable. Robo-advisors may eliminate the risk of human error (and commissions-based advice that may be against your best interests as an investor), but they also rely entirely on computer-generated algorithms that lack a human touch.

SoFi’s financial planners are all 100% certified, with the Series 65 designation or similar, and are held to a high fiduciary standard. They’re also noncommissioned, so they don’t make any money off of selling specific products or services, meaning they won’t try to upsell you.

Instead, they’ll give you personalized advice based on your risk-tolerance and financial goals – or just offer some much-needed reassurance that you’re still on the right track.

This is something that computer-generated algorithms simply aren’t capable of providing. AI technology hasn’t reached that level of sophistication just yet.

SoFi’s financial planners are available via phone or video call, Monday through Friday, from 10:30 AM until 11:00 PM (Eastern Standard Time). If need be, there are also some weekend meeting slots available by special request.

Even better, as a SoFi client, you’ll have unlimited access to these financial planners – at no cost to you. It’s a complimentary service, much like their member experiences.

Customer Support

Investing is a complicated activity – and when you’re investing through an online brokerage, there are a host of technical difficulties that can arise. SoFi offers designated customer support to help you tackle and resolve any such problems.

Similar to their financial advisors, their customer support is available at a wide range of hours: from 7:00 AM until Midnight, Monday through Thursday, and 7:00 AM until 8:00 PM, Friday through Sunday. (Times are given in Eastern Standard Time.)

High-Interest Savings

As mentioned in our review introduction, SoFi isn’t merely an investing platform (and didn’t even start out as one).

Their SoFi Money service acts as a high-yield savings account, with an APY of 2.25% (subject to change). It also benefits from up to $1.5 million in FDIC insurance – six times the cover offered by banks. SoFi Money is also available free of account fees. You’ll even get reimbursed on all ATM fees.

Special Promotion

If you’re already a SoFi client using any of their other services, it’s certainly going to be worth investing with them too, as SoFi Automated Investing customers sometimes get reduced interest rates on SoFi loans.

And even if you don’t need a loan and just want to invest, as long as you make monthly deposits of at least $20, you’ll get free access to the member experiences.

SoFi Cons

Unfortunately, there’s no such thing as a perfect investment platform. While SoFi comes rather close, there are a few areas where we feel some of their competitors are a stronger contender.

No Tax-Loss Harvesting (yet)

Tax-loss harvesting, as mentioned earlier, is a major consideration for many serious investors.

At the moment, SoFi doesn’t offer any tax-loss harvesting services. This may give investors cause to reconsider at present, but the company has announced that they intend to introduce tax-loss harvesting in 2019.

Limited Account Types

SoFi only offers taxable accounts, both for individuals and as a joint account, and select individual retirement accounts (IRAs): Traditional, Roth, SEP, and Rollover.

This means you can’t open a 529 savings plan or a 401k with SoFi.

The company has announced that they intend to introduce more account types in the future, but so far there’s been no indication as to what accounts this will include – or when they can be expected.

A Clean Slate

Usually, having a clean slate is a good thing.

But when it comes to investment platforms, that isn’t necessarily the case. SoFi Invest is pretty much brand spanking new, having only been introduced in 2017. That means their track record is very limited, which typically gives discerning investors reason to pause.

Is SoFi Right For You?

If you’re already a SoFi customer, it definitely makes sense to stick with the company. Having all your accounts in one place makes it incredibly easy to keep track of all your finances. They even have an app to help you with that – SoFi Relay.

On the other hand, if you’re not a SoFi client, you may want to ask yourself whether or not one of their competitors with a longer track record might be the better option. They may not necessarily be, but you should make an informed decision rather than merely jumping at the obvious advantages SoFi offers.

Conclusion

With their highly competitive cost-efficiency and support, SoFi is certainly one of the most attractive investment platforms we’ve reviewed, especially from a beginner’s perspective. Students and recent graduates especially will benefit from the wide range of services offered by the company.

More experienced traders, on the other hand, may want to wait for SoFi to announce their tax-loss harvesting introduction before switching over.